Global Blockchain Market Investment Forecasts

In general, the analysis shows that, although we are dealing with a scenario in which there is a clear idea that this technology will be especially relevant in the coming years, it still seems too early to see the mass implementation of solutions based on it in the real world.

Consequently, a significant increase in investments in the development of blockchain is expected, but there are no concrete forecasts yet regarding the possible benefits that it will bring to various industries.

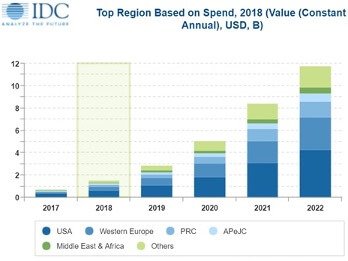

As stated by IDC («International Data Corporation») in a press release, according to its «Worldwide Semiannual Blockchain Spending Guide», this world leader in market analytics predicts that global investments in blockchain amounted to $ 1.5 billion in 2018, which is twice as much as in 2017. The company expects that the cumulative annual growth rate (CAGR) of these investments will be 73,2% in the period 2017-2022. This will bring the volume of investments to 11.7 billion US dollars by 2022.

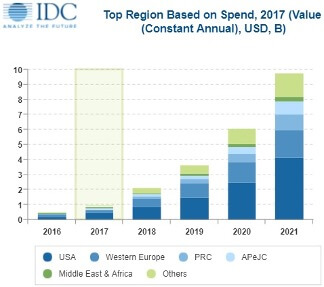

Despite the impressive numbers, these forecasts represent a downward correction compared to the forecasts made by the same company in the previous version of the aforementioned guidance, as reflected in its press release in January. In 2018, the projected global spending on blockchain amounted to $2.1 billion, and in the period 2016-2021, the CAGR amounted to 81,2% and reached a total investment of $9.7 billion in 2021.

Both studies, however, reflect more optimistic forecasts than previous studies, for example, conducted by Esticast Research & Consulting in June, which predicted that the global blockchain market will reach $9.6 billion by 2024.

Investment forecasts by geography and sectors

According to the latest of the aforementioned releases, as well as another IDC release dedicated to data on Europe, in the period 2017-2022, the largest investments in blockchain were made and will be made in the United States — more than 36% of global spending.

On the other hand, Europe is expected to become the second largest investor, increasing its spending from $400 million in 2018 to $3.5 billion in 2022, which represents an annual growth rate of 80,2%. In all regions considered in the handbook, there will be significant growth, with Japan and Canada leading with a CAGR of 108,7% and 86,7%, respectively.

As for global investments in blockchain by sector in 2018, according to the report, they were led by the financial sector (mainly due to rapid implementation in the banking sector) — $ 552 million. It will be followed by the distribution and services sector with 379 million US dollars, as well as the manufacturing industry with 334 million US dollars.

The industries in which the fastest investment growth in the world is observed in 2017-2022 are manufacturing (CAGR 78,8%), professional services (CAGR 77,7%) and banking (CAGR 74,7%). In terms of technology, IT and business services account for about 70% of the total investment during this period. They are followed by investments in software for the Blockchain platform, which will become one of the fastest growing categories along with security software.

The financial services sector will also be the main engine of investment in Europe — 173 million this year (42% of the total). Other fast-growing markets will be linked to supply chains (such as manufacturing and retail) with growth rates of 82,7% and 82,5%, respectively. Sectors such as utilities, professional services and management are also expected to see significant growth. From the point of view of technology, the growth of investments will also be driven by IT services (more than two-thirds by 2022), mainly in IT projects and consulting. The growth of investments in software and hardware, on the contrary, will make up a small share of the total volume.

Analysis of the current and expected level of acceptance

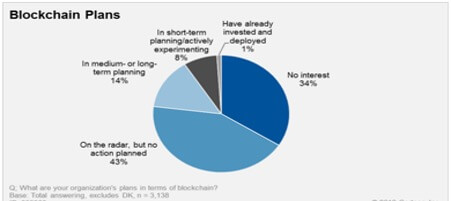

According to the analysis of the «2018 CIO Agenda Survey» conducted by Gartner in October 2017, only 1% of the surveyed IT directors indicated some form of blockchain implementation in their organizations, and only 8% planned to do so in the near future. In addition, 34% said that their organizations are not interested in this technology. IT directors also recognized that the introduction of blockchain will change the business and operational models of organizations, which makes this problem ready to be solved.

In this study, Gartner collected data from 3,160 CIOs from 98 countries from all major industries, representing approximately $13 trillion in revenue and $277 billion in IT investments.

According to the analysis of the data obtained by Gartner, it is obvious that the levels of adoption and implementation of Blockchain, as well as its capabilities at the time of the study, were far from existing expectations regarding the transformation it will bring in the future for companies, industries and society. As a result, they point out that organizations that rush to implement it may face problems associated with unsuccessful innovations, wasted investments and rash decisions, which may even lead them to prematurely abandon this technology. The difficult situation with inflation cannot be discounted either.The Blockchain Revolution, according to Coinmarketrate.com, has serious implications for current business models and operational models, so while many industries are showing initial interest in Blockchain, it remains to be seen whether they will adopt appropriate decentralized and distributed systems, or simply implement the technology into their own current systems.

The time required to redesign these models, as well as changes in the operational structures of organizations, the need to understand and master security issues, legislation, architecture and taking into account the current economic situation in a world plagued by inflation — these are the reasons, according to Gartner, for the gap between expectations from Blockchain and its actual implementation and adoption today.