Сapital market switching to blockchain, in the right way now

Just yesterday, the world of finance did not take cryptocurrencies seriously, but looked at the blockchain with distrust and sarcasm. Even the first steps towards understanding this technology have not brought great results. There are many reasons for this: regulation, the necessary coordination of a large number of players, or even the redesign of processes. However, in addition to technology, regulation has also been progressing recently. Will capital markets soon have their own Spotify with blockchain?

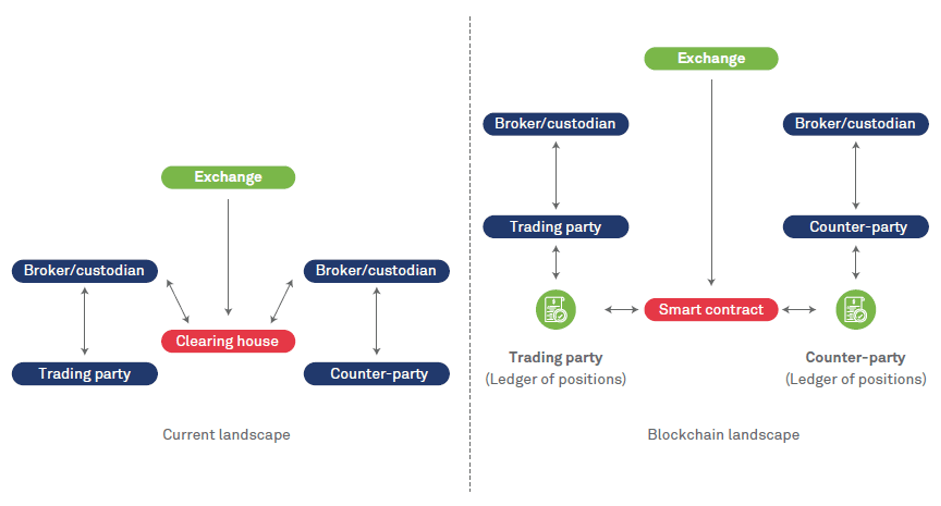

The structure of capital markets with their long technological chain and numerous parties involved leads to the fact that a simple change of the owner of a security takes two days (T+2). At all stages (from trading to clearing and settlement), various intermediaries and infrastructure providers are involved, and they need time.

Most activities can be described as trust work: it is about coordination in the process of transferring value and confirming the authenticity of this coordination between many participants. Digitalization is the central innovation of blockchain technology.

In a fully blockchain-based capital market system, trading, clearing and settlements take place in one automated step «from end to end»: in the process of a smart contract, tokenized securities and money are exchanged in a digital exchange of values. This is displayed to the registrar with almost no time delay, the process works close to real time, in any case at T=0 and 24/7.

Most of the participants in the previous trading of securities based on certificates become unnecessary in this process. Their conciliatory work and positions of trust are no longer needed. The functions of the trust, book issuance and settlement are displayed in a digital cryptographic format. The storage of tokenized money and securities is recorded in the blockchain.

In the traditional securities trading process, a contract note distributed to all parties establishes the current truth about the ownership of the security, which is then entered into various central databases. In blockchain-based processes, the truth about ownership is recorded in the blockchain for public viewing and cannot be falsified.

The breakthrough has not yet been realized

In this regard, the question arises: if the capital market is one of the main options for using blockchain, why does it not exist yet or exists only in its infancy? Moreover, the Law on Electronic Securities (eWpG) has already abolished the certificate requirement for securities in June 2021, and cleared the way for their tokenization.

Since then, tokenized securities have been issued, but there has not been a big breakthrough. Among other things, this is due to the fact that electronic securities cannot yet be admitted to listing on regulated markets, since there are no certain prerequisites for this, such as crediting securities to the central securities depository account. And also because the type of securities is limited to bonds and stocks of funds, and so far no successful secondary markets have been created for these securities.

Creating unregulated secondary markets is a very difficult task. It is also necessary to combine many elements of the process with different powers: financial commission, proprietary trading, investment brokerage, deposit acceptance, storage of cryptocurrencies and much more. This complexity undermines the simplicity that the blockchain vision of the capital market promises.

In contrast, the traditional process of securities trading, with its numerous participants, but operating for decades, seems almost simple. For example, investors can quickly, easily and cheaply buy exchange-traded funds (ETFs) from one of the non-brokers. Today, according to the data by bl, ETFs can be tokenized. But the effort expended is so great that it makes sense only in the rarest cases.

Regulation for better vision

Meanwhile, legislators at the national and European levels are working to create a regulatory framework for the blockchain vision, in which its technical advantages can be used.

Via the Law on Future Financing, it is planned to expand eWpG to shares, which will allow tokenizing the most important security from the point of view of a private investor.

At the EU level, a regulation on the «DLT Pilot Mode» was published in June of this year. The DLT (Distributed Ledger Technology) pilot mode defines three new permissions (partially coinciding with eWpG), according to which tokenized securities can be traded on organized markets throughout Europe. They eliminate some of the necessities that previously arose as a result of regulatory work, such as the above-mentioned requirement for a certificate for securities and their receipt for collective storage in the central securities depository.

The DLT pilot mode includes acceptable facts of the DLT trading system (DLT MTF = Multilateral Trading Facility), the DLT settlement system (DLT SS = Settlement System) and the DLT trading and settlement system (DLT TSS = Trading and Settlement System). Without going into the details of the facts, these permission sets allow financial companies to offer retail clients the trading of tokenized securities based on blockchain without intermediaries. Tokenized money can be used as a means of payment for trading.

According to the DLT TSS permission set, trading and settlements can be offered from a single source, which makes it particularly interesting. Already regulated, as well as young fintech and crypto technologies that are not yet regulated, can apply for a permit.

Is three years of pilot mode enough to develop the potential of blockchain for the capital market?

It usually takes some time for the benefits of the new technology to manifest, and the use of the new technology goes beyond simply replacing the previous technology. This can be observed from electrification to digitalization. In the music industry, the vinyl record was replaced by a CD, until modern streaming platforms appeared, with their radically new business models and media use — the «Spotify moment» almost turned the entire industry upside down.

By itself, blockchain would make the capital market more attractive to investors, and would contribute to the development of attachment to securities. Maintaining the existing trading infrastructure requires significant costs. The current business models with ultra-low trading commissions are possible only due to the fact that non-brokers cross-subsidize trade through payment agreements for the flow of orders.

But they are skeptical about this for reasons of investor protection, and are always on the verge of being banned. More efficient trading of blockchain-based securities should also be very inexpensive for the client without counter-financing.

Whether three years of experimental mode will be enough to reach Spotify’s moment for the capital market is still unclear. The first concepts pointing in this direction are already visible: smart securities in the form of programmed smart contracts certify shares of a company or even shares of a machine, whose proportional lease payments fall into the client’s wallet in the form of tokenized cash flow in real time. Or even share streaming platforms that make making a portfolio as easy as playlists.

However, it is likely that we do not yet know the products or processes that cause such an effect. Therefore, we can be inquisitive and look for new ways to use blockchain.